Risk comes hand-in-hand with opportunity. Without it, there would be little potential for growth in an investment portfolio. That said, poor risk management can be a significant obstacle separating investors from their goals. With this in mind, the tenets that guide us include:

To lessen the volatility of Vineyard portfolios, we employ a dynamic risk management process that adapts the level of exposure to what the current environment requires. In a deteriorating environment, protecting against extreme downside risk becomes critical because the more a portfolio loses in value, the greater are the returns required to get back to breakeven. Conversely, in a positive investment backdrop, our goal becomes positioning Vineyard portfolios to participate in the market’s growth.

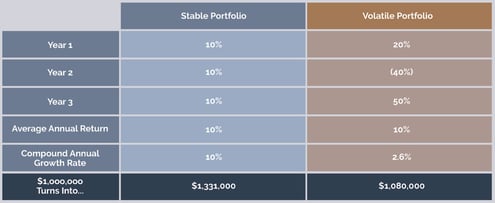

The table below gives a simplified example of what our philosophy looks like in action. It shows how the ability to dampen volatility in a portfolio can make a significant difference in its outcome.

Most risk management measures come at a price, but we believe it’s a price worth paying. In exchange for the costs associated with protecting Vineyard portfolios from significant downturns, we may give up some upside potential. The result is portfolios that tend to experience “lower highs” (i.e., that do not typically achieve the maximum market performance in an up market), but also “higher lows” (i.e., that do not fall as much as the overall market during a severe downturn).

Steadier returns over time help keep our clients on track toward meeting their personal financial goals. Knowing there’s a plan in place to address risk gives them peace of mind, helping them avoid costly, emotionally-driven decisions when volatility strikes.

Vineyard’s product slate covers a broad range of investment objectives. Our security selection process is based on data-driven research that resists the confusing headline noise of the day. Each of our strategies is founded on a rigorous, highly-sophisticated model that screens a given universe of securities for carefully selected “factors”—measurements we use to estimate a security’s potential. The rankings generated by our models are then put through further rounds of analysis to determine whether the timing is right for owning each individual security.

The way risk is handled can have a substantial impact on an investor’s ultimate success. Our approach for all Vineyard strategies involves applying layers of protection as needed in response to changing market conditions, with the goal of providing the most protection during times of significant market deterioration.

Vineyard Global Advisors, LLC (“the Adviser”, “Vineyard Global Advisors”, or “VGA”) is a DBA of Integrated Advisors Network, LLC (“Integrated”). Integrated is an SEC registered investment advisor. Registration does not imply a certain level of skill or training. VGA is affiliated with, but not under common control of, Integrated.

More information about Vineyard Global Advisor, including our investment strategies, fees and objectives, can be found in our Form ADV Part 2A and our Form CRS.

Copyright © 2025 | Vineyard Global Advisors LLC | All Rights Reserved.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Cras eu mauris dapibus ante interdum tempor non eu metus. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia curae; Sed lobortis sodales consequat.